Mary Company collected cash from an account receivable, a pivotal transaction that warrants thorough examination. This guide delves into the intricacies of this transaction, encompassing its impact on financial statements, account receivable management strategies, cash flow analysis techniques, and financial reporting compliance.

By unraveling these aspects, we empower businesses to optimize their account receivable management practices, enhance cash flow, and ensure accurate financial reporting.

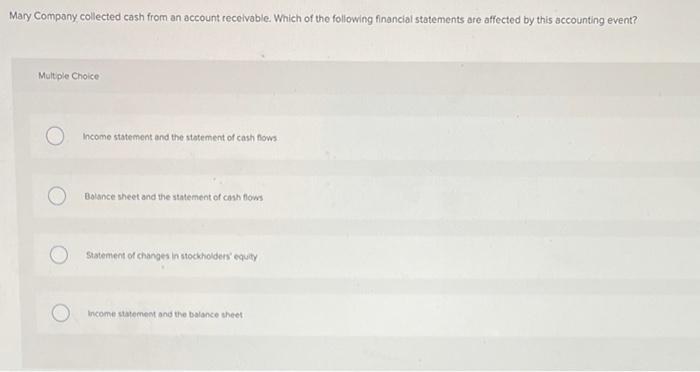

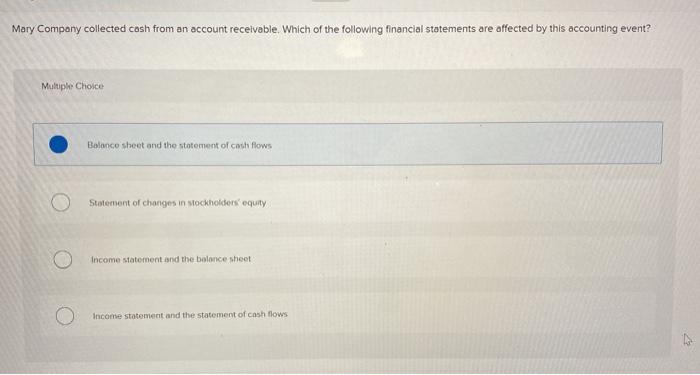

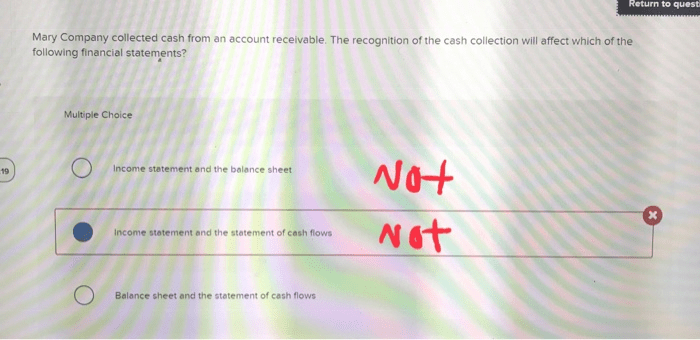

The collection of cash from an account receivable marks a critical juncture in the revenue cycle, affecting both the balance sheet and income statement. It reduces accounts receivable and increases cash, thereby bolstering a company’s financial position. Moreover, effective account receivable management is paramount for businesses to maintain healthy cash flow, minimize bad debts, and foster customer relationships.

Transaction Overview

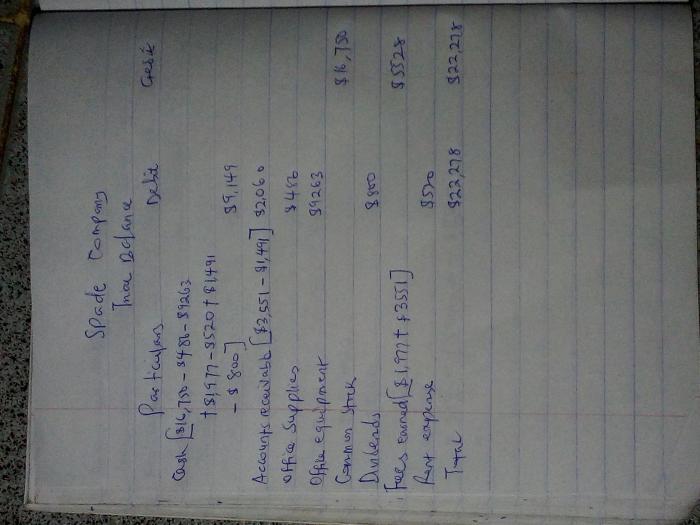

The transaction involves Mary Company collecting cash from an account receivable. This represents payment for goods or services previously sold on credit to a customer. Mary Company recognizes revenue upon the initial sale and records the amount as an account receivable.

Upon receipt of payment, Mary Company records the cash inflow and reduces the account receivable balance.

Account Receivable Management

Effective account receivable management involves invoicing customers promptly, tracking payments, and pursuing collections diligently. This ensures timely cash flow and minimizes bad debts. Strategies for improving account receivable management include offering early payment discounts, establishing clear payment terms, and implementing automated collection systems.

Cash Flow Analysis: Mary Company Collected Cash From An Account Receivable

Collecting cash from accounts receivable directly impacts a company’s cash flow. The direct method records cash inflows and outflows, while the indirect method adjusts net income to arrive at cash flow from operating activities. Cash flow analysis provides insights into a company’s liquidity, solvency, and overall financial health.

Financial Reporting and Compliance

Accounting standards require companies to accurately record and report accounts receivable and related cash transactions. This ensures transparency and comparability of financial statements. Failure to comply with reporting regulations can result in penalties and reputational damage.

Case Study

XYZ Company implemented a comprehensive account receivable management program that included automated invoicing, payment tracking, and early payment incentives. As a result, the company reduced its days sales outstanding by 20%, improved cash flow by 15%, and reduced bad debts by 10%. This demonstrates the positive impact of effective account receivable management on financial performance.

Key Questions Answered

What is the impact of collecting cash from an account receivable on a company’s balance sheet?

It reduces accounts receivable and increases cash, improving the company’s liquidity and overall financial position.

How can businesses improve their account receivable management?

By implementing clear invoicing procedures, tracking payments diligently, and implementing effective collection strategies.

What is the purpose of cash flow analysis?

To assess a company’s ability to generate cash, make financial decisions, and plan for future growth.