Embark on a financial journey with EverFi Module 3 Budgeting Answers, your trusted guide to navigating the complexities of personal finance. This module empowers you with the knowledge and tools to create a budget that aligns with your financial goals, manage expenses effectively, and secure your financial future.

Discover the fundamentals of budgeting, explore various budgeting methods, and learn practical strategies for tracking expenses, saving, and investing. With EverFi Module 3 Budgeting Answers, you’ll gain the confidence to take control of your finances and achieve financial well-being.

Overview of EverFi Module 3 Budgeting: Everfi Module 3 Budgeting Answers

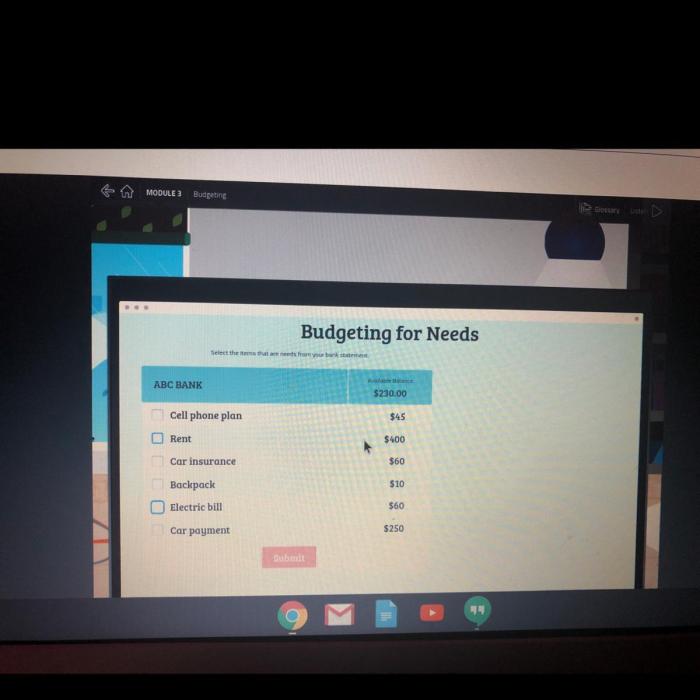

Budgeting is a crucial aspect of financial management that involves planning and allocating income to meet expenses, save for the future, and achieve financial goals. It provides individuals and organizations with a clear understanding of their financial situation and helps them make informed decisions about how to use their resources.

The key steps involved in budgeting include:

- Tracking income and expenses

- Setting financial goals

- Creating a budget

- Sticking to the budget

- Adjusting the budget as needed

Creating a budget offers numerous benefits, such as:

- Increased financial awareness

- Reduced debt and expenses

- Increased savings and investments

- Improved financial security

- Peace of mind

Budgeting Methods

There are several different budgeting methods available, each with its own advantages and disadvantages. Some common methods include:

50/30/20 Rule, Everfi module 3 budgeting answers

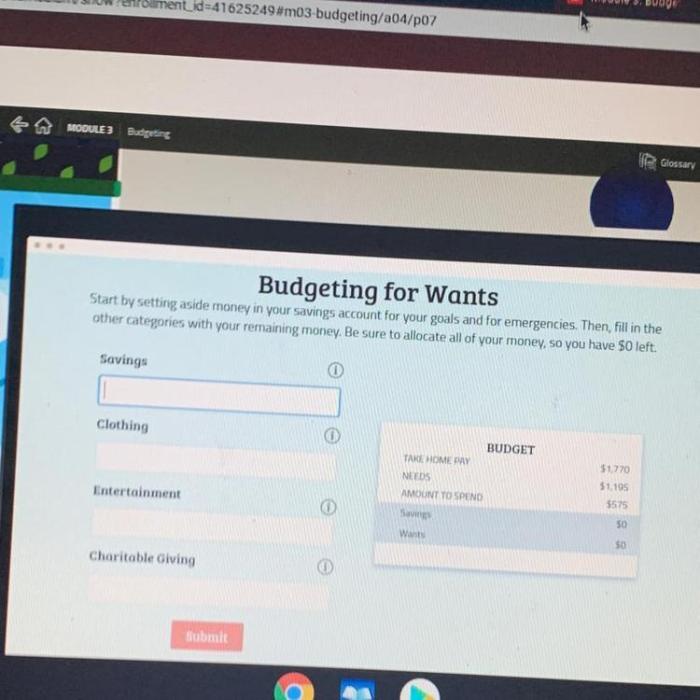

This method divides income into three categories: 50% for needs, 30% for wants, and 20% for savings and debt repayment.

Zero-Based Budgeting

This method requires that every dollar of income is assigned to a specific category, leaving no money unaccounted for.

Envelope System

This method involves using physical envelopes to allocate cash to different spending categories.

The choice of budgeting method depends on individual preferences and circumstances. It’s important to experiment with different methods to find the one that works best.

Creating a Budget

To create a budget, follow these steps:

- Track your income and expenses for a month or two to get a clear picture of your financial situation.

- Set financial goals, both short-term and long-term.

- Create a budget using a budgeting tool or spreadsheet.

- Stick to your budget by tracking your expenses and making adjustments as needed.

When creating a budget, it’s important to be realistic and to include all sources of income and expenses. It’s also important to review and adjust your budget regularly to ensure that it aligns with your financial goals and changing circumstances.

Managing Expenses

Expense tracking is essential for managing expenses effectively. There are various methods for tracking expenses, such as:

- Using a budgeting app

- Using a spreadsheet

- Keeping receipts

Once expenses are tracked, it’s important to identify and reduce unnecessary expenses. This can be done by:

- Negotiating lower bills

- Cutting back on unnecessary subscriptions

- Finding cheaper alternatives to regular purchases

Saving and Investing

Saving and investing are important aspects of financial planning. Saving involves setting aside money for future needs, while investing involves using money to generate growth over time.

There are different types of savings and investment accounts available, such as:

- Savings accounts

- Money market accounts

- Certificates of deposit (CDs)

- Stocks

- Bonds

It’s important to set financial goals and develop a savings plan to achieve them. This plan should include determining how much to save each month, where to save it, and how to invest it.

Budgeting for Specific Situations

Budgeting is not just about managing day-to-day expenses. It’s also about planning for specific life events, such as:

- Buying a house

- Having a child

- Retiring

When budgeting for specific situations, it’s important to consider the following:

- The cost of the event

- The time frame for the event

- Your financial goals

It’s also important to adjust your budget to meet changing needs. As your income and expenses change, you may need to make adjustments to your budget to ensure that it remains effective.

FAQ Corner

What are the key steps involved in creating a budget?

1. Track your income and expenses 2. Set financial goals 3. Create a budget plan 4. Adjust your budget as needed

What is the 50/30/20 budgeting rule?

The 50/30/20 rule allocates 50% of your income to essential expenses, 30% to non-essential expenses, and 20% to savings and investments.

What are some tips for sticking to a budget?

1. Track your expenses regularly 2. Set realistic financial goals 3. Automate savings and investments 4. Seek support from a financial advisor if needed